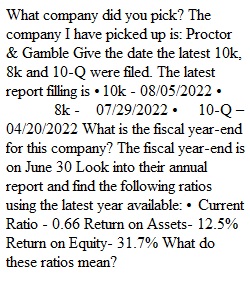

Q Module Seven Homework Go into Shapiro Library Online. Search for Hoovers Choose first link and Log into Hoovers. Or log into EDGAR. Find a company to research (e.g., Exxon Mobile). If in Hoovers, chose the financials tab and go to SEC filings. Write a one to two page short paper, in paragraph format, that addresses the following questions. What company did you pick? Give the date the latest 10k, 8k and 10-Q were filed. What is the fiscal year end for this company? Look into their annual report and find the following ratios using the latest year available: Current Ratio Return on Assets Return on Equity What do these ratios mean? Compare and explain the change in Gross Profit Margin for the most recent two years posted. (Did it change due to Revenue or Costs or both?) Check out the Balance Sheet. What is the change in Long Term Debt from prior year to most current year? Why the change? What is the change in Inventory from prior year to current year? Why the change? Check out the financials and other information about this company. Does the company pay dividends? Do you think you would be comfortable purchasing stock in this company if it is a publicly traded company? Why or why not?

View Related Questions